2025 Capital Gains Tax Calculator. We built a free calculator to estimate how much capital gains tax you'll owe. 9 rows use this tool to calculate how much capital gain tax you will need to pay on gains from your asset sell.

However, for 2018 through 2025, these rates have. How it works, rates and calculator.

The Above Calculator Is Only To Enable Public To Have A Quick And An Easy Access To Basic Tax Calculation And Does Not Purport To Give Correct Tax Calculation In All.

An online calculator that is easy to use helps you determine the capital.

Estimate Capital Gains Tax Liability By Downloading Year End Documents Received From The Depositories.

Industry and investors have been seeking a simplification of the regime.

2025 Capital Gains Tax Calculator Images References :

Source: www.sappscarpetcare.com

Source: www.sappscarpetcare.com

Capital Gains Tax Calculator, The present provisions of determining capital gains tax are complex and varied. The tax that you have taken from the profit which you have gained from selling or disposing of an asset that has increased in value is called capital gains tax.

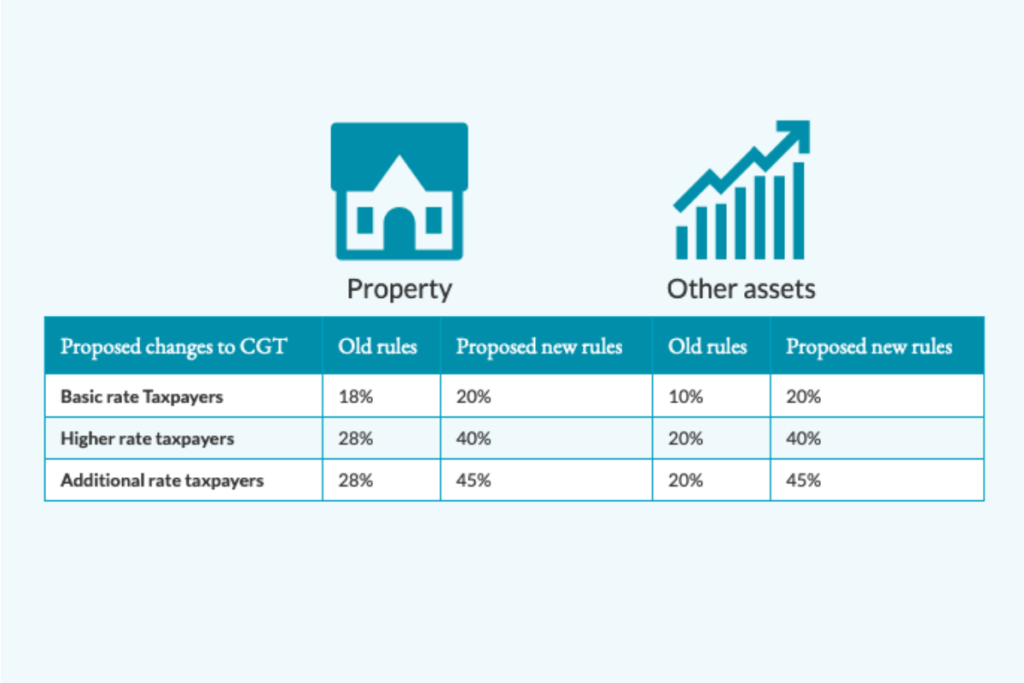

Source: burnsandwebber.designbyparent.co.uk

Source: burnsandwebber.designbyparent.co.uk

How Capital Gains Tax Changes Will Hit Investors In The Pocket Burns, The standard deduction for taxpayers younger than age 65, currently $14,600 (single) and $29,200 (married filing. When the tax rate is the same across asset classes, investors can make decisions based on the economic potential of the.

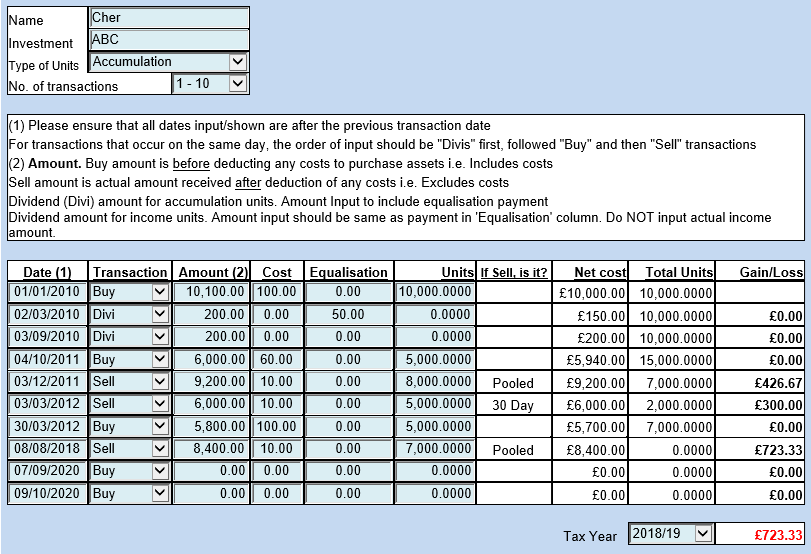

Source: www.tfpcalculators.co.uk

Source: www.tfpcalculators.co.uk

Capital Gains TFP Calculators TFP Calculators, When shares are sold one year after purchase, the gains earned amounting to ₹1 lakh and above are taxed as per the provision of long term capital gains. A superb online calculator for individuals and business to calculate capital gains tax in australia.

Source: www.transformproperty.co.in

Source: www.transformproperty.co.in

The Beginner's Guide to Capital Gains Tax + Infographic Transform, Updated as per latest budget on 1. If you earn $40,000 (32.5% tax bracket) per year and make a capital gain of $60,000, you will pay income.

Source: www.youtube.com

Source: www.youtube.com

Tax calculator Capital Gains Tax (CGT) when selling a buy to let, Income tax department > income and tax calculator income tax department > tax tools > income and tax calculator. The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all.

Source: carlyeqstephani.pages.dev

Source: carlyeqstephani.pages.dev

Federal Capital Gains Tax On Real Estate 2024 Leela Myrlene, How it works, rates and calculator. An online calculator that is easy to use helps you determine the capital.

Source: www.ipsinternational.org

Source: www.ipsinternational.org

Unveiling Form 1099 Reporting ShortTerm Capital Gains, You may owe capital gains taxes if you sold stocks, real estate or other investments. The tax that you have taken from the profit which you have gained from selling or disposing of an asset that has increased in value is called capital gains tax.

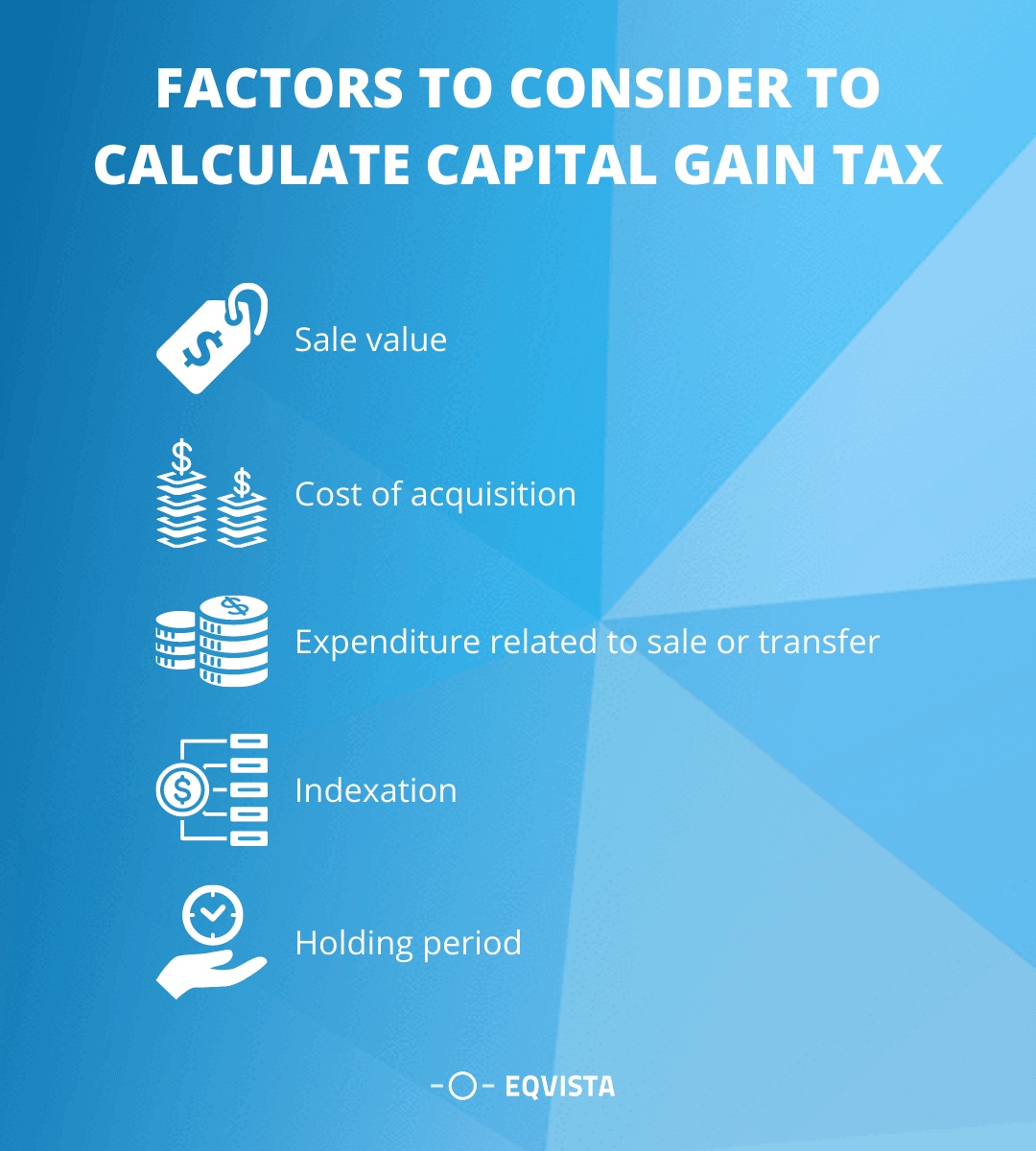

Source: eqvista.com

Source: eqvista.com

How to calculate capital gain tax on shares in India? Eqvista, See how the latest budget impacts your tax calculation. Industry and investors have been seeking a simplification of the regime.

Source: thenewsintel.com

Source: thenewsintel.com

ShortTerm And LongTerm Capital Gains Tax Rates By The News Intel, The capital gains tax calculator can also help you with your tax planning to find out if you have a capital gain or loss and compare your tax outcome of a short term. See how the latest budget impacts your tax calculation.

Source: esperwealth.com

Source: esperwealth.com

Capital Gains Tax. The basics explained. Esper Wealth, See how the latest budget impacts your tax calculation. You may owe capital gains taxes if you sold stocks, real estate or other investments.

The Present Provisions Of Determining Capital Gains Tax Are Complex And Varied.

Capital gains are any profits made by selling capital assets, such as equities, property, land, gold, etc.

If You Earn $40,000 (32.5% Tax Bracket) Per Year And Make A Capital Gain Of $60,000, You Will Pay Income.

We built a free calculator to estimate how much capital gains tax you’ll owe.

Category: 2025